View New Posts

CONTACT THE ADMIN

All rights reserved. Solomonet, LLC ©2009-2025

Powered by phpBB® Forum Software © phpBB Limited

BullionStacker is not responsible for any trades made on this website, please use your own common sense when dealing with other users.

CONTACT THE ADMIN

All rights reserved. Solomonet, LLC ©2009-2025

Powered by phpBB® Forum Software © phpBB Limited

BullionStacker is not responsible for any trades made on this website, please use your own common sense when dealing with other users.

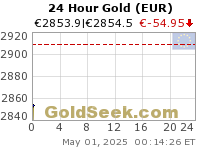

![[Most Recent Quotes from chartseeker.com]](https://www.chartseeker.com/images/XAUXAG-24HR-SM.png)